Posts

8 Steps to Migrate Your Business to the Cloud

As a business owner, transitioning to the cloud can seem daunting, but it doesn't have to be. Follow these simple steps to smoothly migrate your business operations to the cloud.

What is labour productivity and how does it impact your business?

What is productivity exactly (hint: it’s not about working longer hours) and how can you lift it in your small business?

A Look into Xero Invoicing Updates

Xero has announced that they will be retiring the older version of their invoicing product from September 2024.

Xero Beautiful Business Fund submissions now open

Xero small business customers have until 6 October 2023 to enter to receive a share of $750k in funding globally.

Apply for Xero Beautiful Business Fund

Xero has announced the launch of their Beautiful Business Fund, an initiative backing business for the future with a share of funding available to Xero customers so your business can keep doing what it does best. Register now.

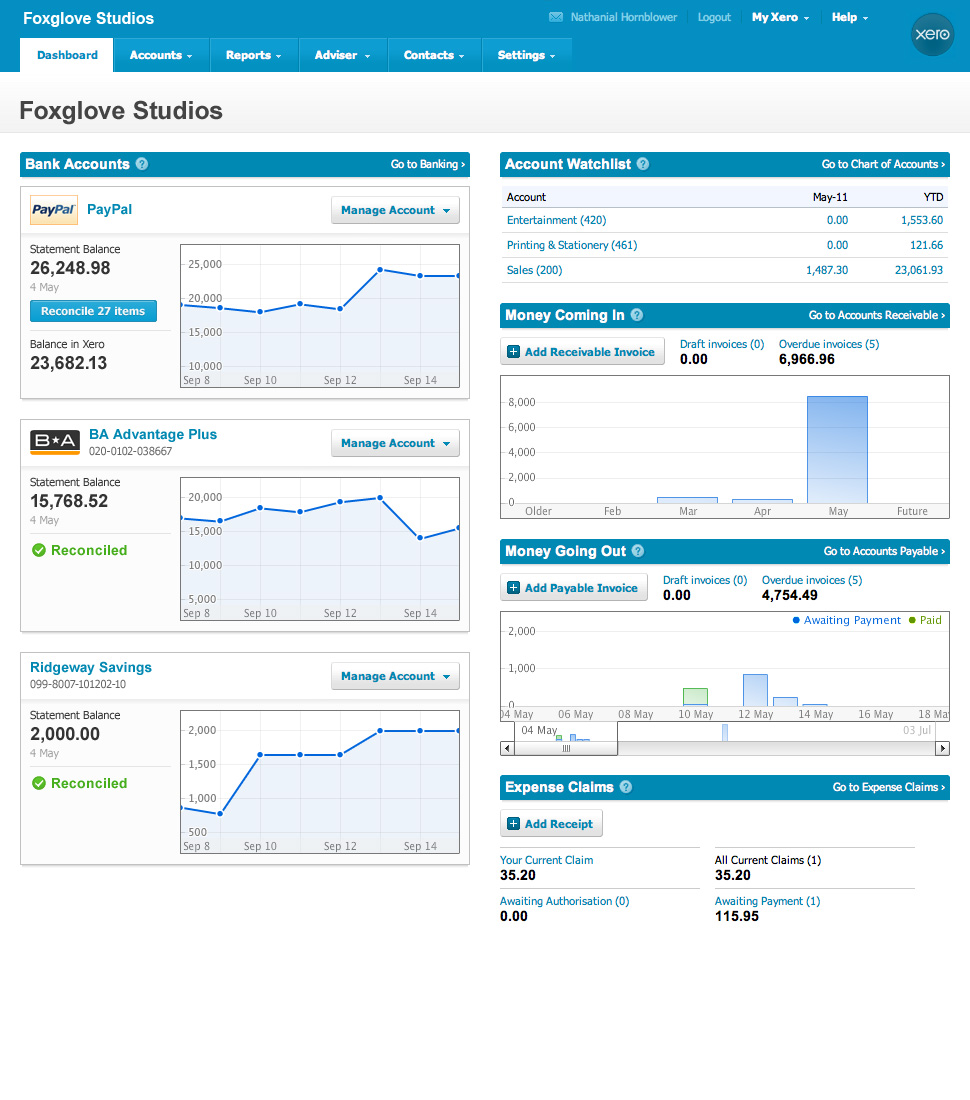

Moving to new Xero Reports

Xero will be transitioning some favourite ‘starred’ reports from the old version to the new version. The new versions offer more flexibility and customisation, quicker access to insights and deeper analysis of business performance.

5 tips for Xero users

Here are five useful tips from this year’s Xero quarterly product updates to make you more efficient when using Xero.

Complete tasks for your tax period

Financial year end is the perfect time to do a check-up, celebrate your successes, and refocus on business goals.

Australian financial year calendar FY22

A lot of things need to happen between the end of financial year (EOFY) and tax time. Here are the dates and deadlines to keep in mind when getting tax ready.