7 Ways to Get Better Deals from Suppliers

In the competitive business world, getting the best terms with suppliers improves margins and lays a foundation for long-term success. Here are seven ways to get better deals with suppliers.

Strategies to Boost Business Cash Flow

We sometimes see businesses that are healthy, growing, reputable and stable, but their cash resources are limited. We explain how to improve your cash flow.

CSIRO ‘Innovate to Grow’ program

‘Innovate to Grow’ is a free, 10-week program assisting Australian SMEs to explore and use R&D for growth in advanced manufacturing solutions. Applications close on 12 May 2024.

AI Adopt funding program

Funding is open for Artificial Intelligence (AI) Centres to help SMEs adopt AI technologies. Applications close 29 January 2024.

Qld Workforce Connect Fund

Through the Workforce Connect Fund, Qld small businesses can apply for an HR Support Grant of up to $5,000 to implement new and innovative HR solutions to address an immediate need.

QLD Ignite Spark Funding closing soon

The Ignite Spark Program aims to support Queensland-based small to medium-sized innovation-driven enterprises with high-growth potential to progress the development of an innovative product or service closer to market.

Getting paid on time

Businesses thrive when the cash position is healthy — let's look at some Best Practices in the area of Accounts Receivable aka Collections.

Another $2.5M in grants for QLD small businesses

Business Boost grants of up to $20,000 to help Queensland businesses are up for grabs with $2.5 million available in this round. Applications close 12 September 2023.

Project Trust Accounts for QLD Tradies

The Queensland Government has announced an extension of the commencement date for eligible contracts under the Project Trust Accounts (PTA) framework, providing further security of payment for tradies.

Energy Efficiency Grants for SMBs

Funding to purchase energy-efficient equipment upgrades for small and medium businesses is available now. Applications close 19 April 2023.

Made in Queensland

Made in Queensland is a State Government program helping small and medium-sized manufacturers to increase international competitiveness, productivity and innovation. Round 5 closes 12 Dec 2022.

Regional Futures – Collaborative Projects QLD

Funding for regional Queensland collaborations is available to solve significant innovation challenges within the state.

Complete tasks for your tax period

Financial year end is the perfect time to do a check-up, celebrate your successes, and refocus on business goals.

QLD flooding assistance extended

Low-interest loans are available for small businesses and primary producers in local government areas facing a massive clean-up operation in the aftermath of the flooding in Southern Queensland.

Brisbane Suburban Shopfront Improvement Grants

Suburban Shopfront Improvement Grants provide up to $5000 to property owners or tenants in local business precincts to bring a fresh new look to their shopfronts.

Disaster assistance for latest QLD flood event

Queenslanders impacted by floods can now register to access additional support from the DRFA and the Resilient Homes Fund.

Grants for bank customers impacted by floods

The Big 4 banks have pledged support for New South Wales and Queensland customers impacted by flooding by granting financial assistance in the form of relief packages.

Australian Government Disaster Recovery Payment for NSW, QLD flood victims

Residents in 26 flood-affected LGAs across Queensland and NSW can apply for AGDRP financial support via Services Australia from 1 March.

2020 Notch Above Bookkeeping

2020 Notch Above BookkeepingManaging business cash flow and income

While 2022 will hopefully be a year of rebounding sales and revenue, business owners need that to carry through to the bottom line. Here are 4 steps to help support that recovery.

Xero’s small business trends report 2022

After two challenging years, small businesses may be eyeing a cautious recovery going into 2022.

2020 Notch Above Bookkeeping

2020 Notch Above BookkeepingManage your business cash flow

A cash flow budget or projection, and having enough cash at the right time, makes it easier for business owners to pay bills and other expenses and meet tax, super and employer obligations.

4 Start Up Tips for Budding Entrepreneurs

Starting your own business can feel like you’re in a pressure cooker with newfound worry about when the next dollar will land in your bank account. However there are some solid steps that owners of start-ups can take from Day 1 to keep finances in check and make what should be an exciting process less daunting.

Cut costs or continue spending?

With the economy in recession, many businesses have faced the challenge of re-evaluating how they operate One of the most difficult decisions is whether to cut costs or continue spending. But which of these activities could help increase your profits to build a more resilient business?

Tips for Maintaining and Managing Good Cash Flow

Read why having adequate working capital at all times is really important, and managing this capital carefully is critical.

Understand customer mindset to respond to buying patterns

As the government restrictions to protect our health eventually ease, people will adapt to the changes at different speeds. Those variations will, in turn, have big impacts on sales for small businesses. How do business owners respond?

Know your boosts inside and out

If you've received a cash flow boost, you may be wondering if the amounts you've received affect your income or deductions this tax time. Here are the 4 essentials to know when lodging your tax return.

Business advice for a new financial year

Emerging from challenging times, we outline some helpful planning tips for business owners this financial year.

COVID-19 Cash Flow Boost

18 Comments

/

The Tax Office has announced that the cash flow boosts will be applied to reduce liabilities arising from the same activity statement but will not be offset against existing BAS debt but rather refunded to you.

Economic Stimulus Package

The Government has announced a $17.6 billion economic plan to keep Australians in jobs, keep businesses in business and support households and the economy as the world deals with the significant challenges posed by the spread of the coronavirus.

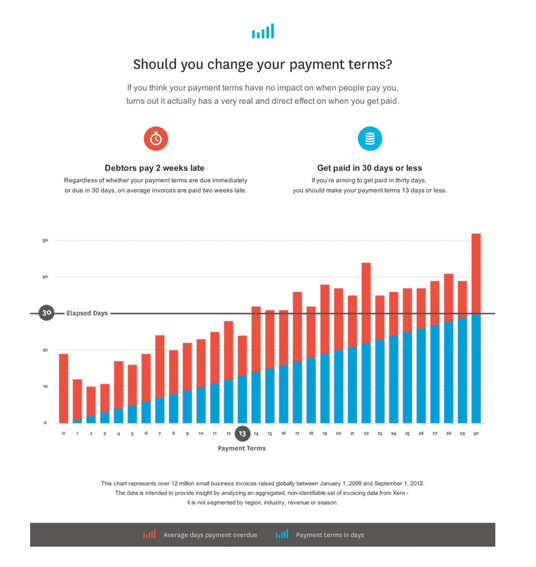

The human cost of late payments

Late payments affect business from financial and operational…

Got cash for Christmas?

It would be nice if you could send an invoice, then sit back and watch the money roll in. But half of all invoices are paid late. And some aren’t paid at all. So how do you handle outstanding invoices so you can be sure to have cash for Christmas?

How to Give More This Christmas By Spending Less

As a business owner, Christmas is the perfect time to give back to your clients, customers and employees. However, sometimes I have to play devil’s advocate with my clients when it comes to their Christmas shopping sprees.

Are you on track with your business goals?

As we come to the tail end of winter – hurrah! – some of…

5 Quick Tips for Faster Customer Payments

Agree amounts upfront

Invoice immediately

Multiple…

Statement of cashflow

For small businesses a healthy cashflow is crucial. That’s…

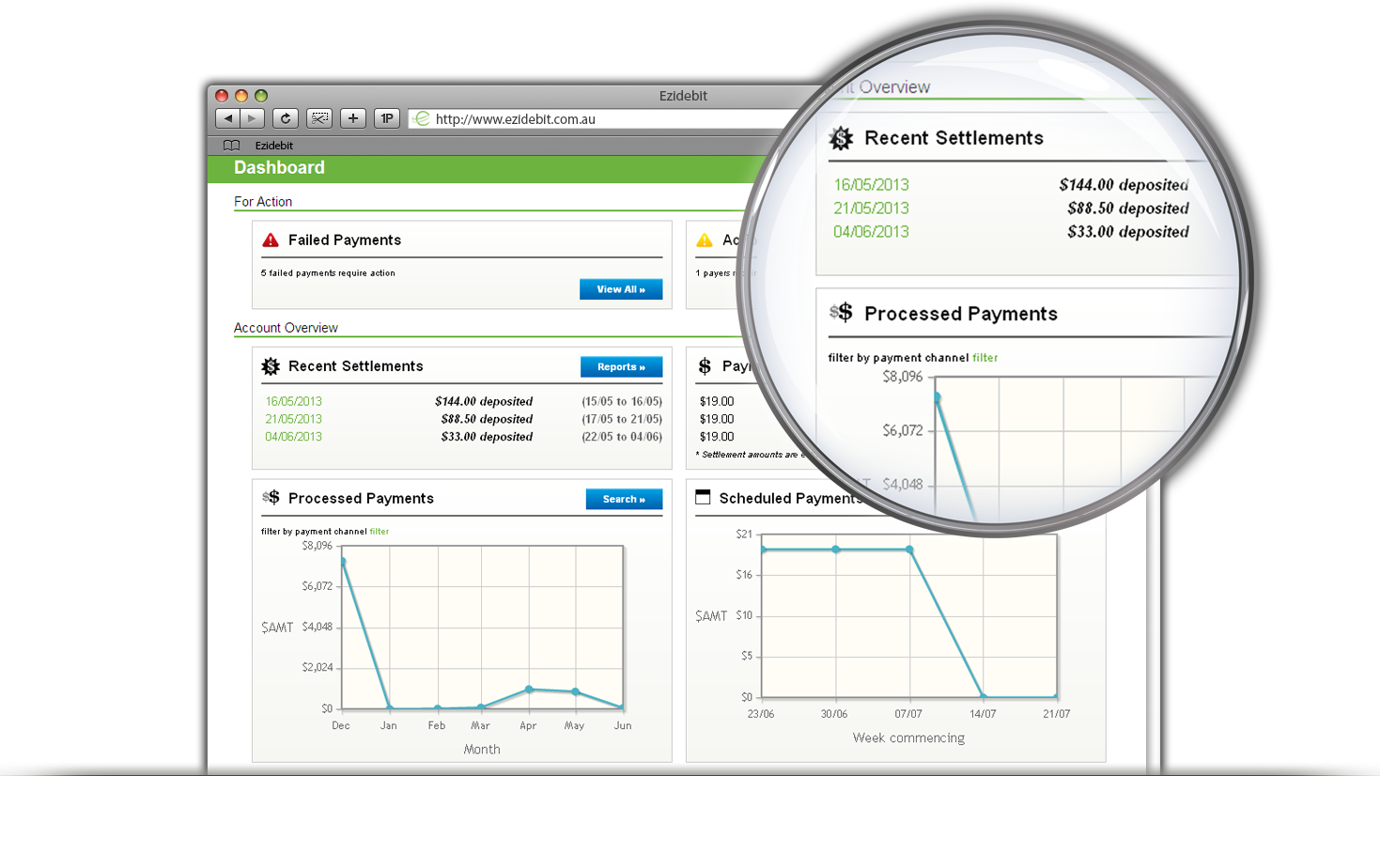

How automated payments can improve your competitive advantage

If you’ve been following our blog for a while, you will be…

Grow your business : 10-step checklist

10 steps for business growth

Seeing an opportunity for…

4 Ways to Improve Small-Business Cash Flow

A lot of small-businesses focus on profit, but cash flow is just…

Collect your cash faster – Streamline your Invoice Process

Invoicing is an important part of small business accounting.…