What is labour productivity and how does it impact your business?

Unlocking the Power of Efficiency

Insights and Strategies for Small Business Owners

If you or your clients are looking for ways to grow profits, drop prices or pay staff more, then one strategy is to lift productivity in your business. But what is productivity exactly (hint: it’s not about working longer hours), and how can you lift it in your small business or practice?

What is small business productivity?

Small business productivity is the measure of how much value a business can produce using the resources it has at its disposal (ie staff, capital, materials). It’s usually measured using the dollar-value of outputs per hour worked or per employee. To put it more simply: sales/hour or sales/employee. Generally, the higher the sales/hour, the more productive a business is.

New insights on small business productivity

A new Xero Small Business Insights (XSBI) report has been released, Small business productivity: Trends, implications and strategies, looking at recent small business productivity trends across Australia, New Zealand and the United Kingdom. In addition to trends and insights, the report also provides some tips on how you can lift productivity in your business and for your clients.

Measuring labour productivity isn’t new, but what’s out there is generally broader, slower to be released and covers longer periods of time (quarterly or annual). Methodologies also tend to differ. This XSBI data is the first time that small business labour productivity has been measured using anonymised and aggregated data (not surveys) for small businesses only, on a monthly basis, and using the same methodology across each country.

Technology can improve productivity

One of the main findings of the report was evidence of the productivity boost small businesses can get from embracing digital tools.

General economic wisdom is that small businesses tend to have lower productivity than large businesses. But the study found that, particularly after the pandemic, small businesses tended to have higher productivity growth when compared with data covering all businesses in a country.

One reason for this result is down to a key characteristic of the small businesses in the XSBI data set – by definition they all use at least some form of technology (like Xero) to help run their business, and they have an accountant or bookkeeper too. This finding really highlights the benefits that digital technology (or digitalisation) can deliver to small businesses that embrace it, especially with the help of their advisors.

It also highlights the huge opportunity available to governments from policies that encourage all small businesses to embrace digitalisation in their operations.

How did the pandemic impact productivity?

Unsurprisingly, productivity in all three countries took a hit during the peak pandemic years of 2020 and 2021. Many small businesses were forced to temporarily close but still paid their staff, thanks to government wage subsidy schemes. This meant that even though businesses were paying staff, they were producing or selling much less, resulting in much lower productivity.

Once economies re-opened, sales took off but small businesses struggled to find more staff. Existing workers had to step up and lift their productivity to keep up with the surge in customers. As things settled down, this post-pandemic ‘productivity spike’ unwound due to slowing sales growth and the need to train some of the newly hired staff. Come December 2023, all three countries’ productivity has slipped below pre-pandemic averages.

This softening of productivity over 2023 adds to the economic challenges we face: how to lift economic growth and get inflation back to normal as quickly as possible. Boosting productivity is a great way to do both of these.

What does this mean for your business?

Productivity is about working smarter – it’s not about working longer hours. If you and your clients already use tech tools in your businesses, then you’re already ahead of your competitors that aren’t. But that doesn’t mean your businesses are as productive as they could be. To help understand how to lift productivity in your businesses, Xero has put together a handy guide: Increasing productivity in small business.

The steps you and your clients can take fall into four broad areas:

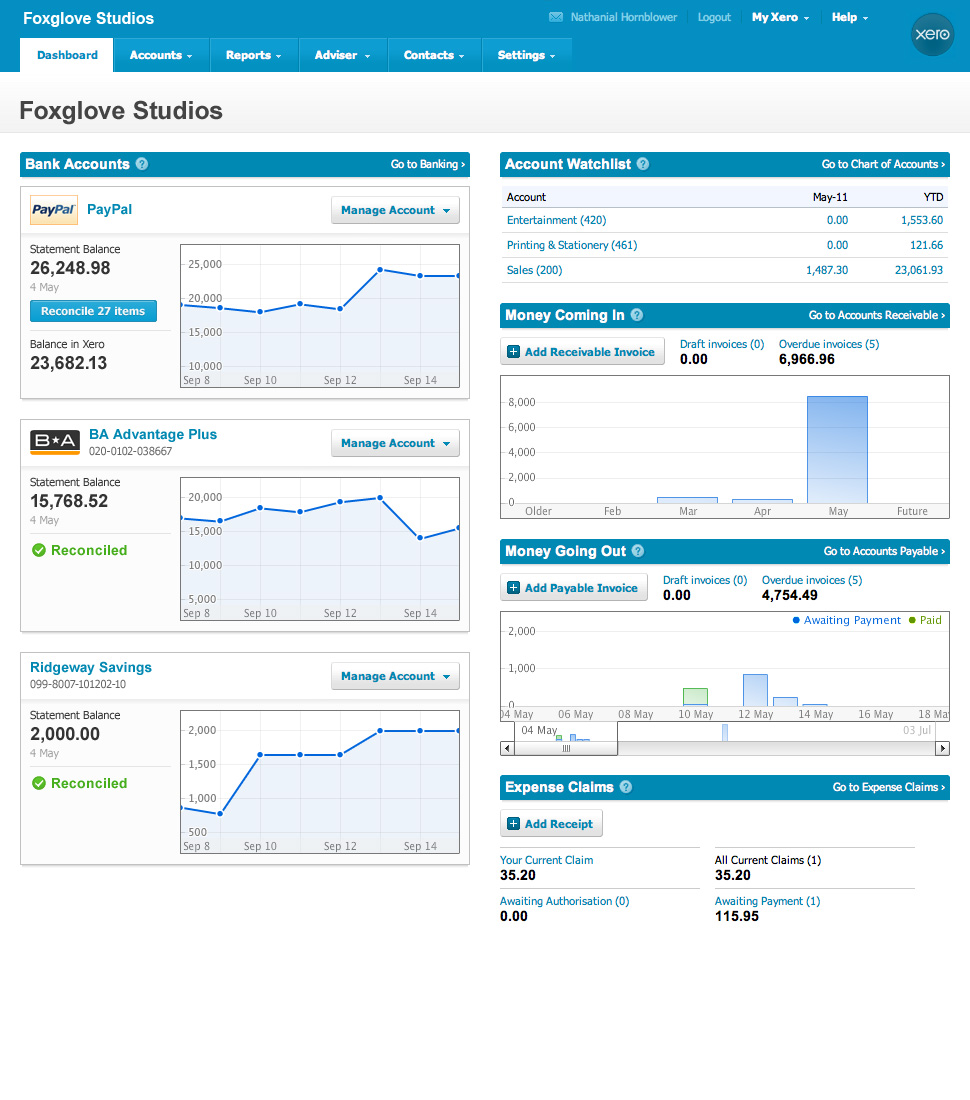

- Find tools that amplify your work and invest in them. You could start this by simply finding out which Xero App Store apps might be useful to add to your stack and help you run your business better

- Reevaluate your current processes: are they really working?

- Set your workers up for success through upskilling and training

- Harness your entrepreneurial skills to build a business that operates at its full potential

GET XERO TRAINING

Learn how to take advantage of all Xero’s cool and sophisticated bookkeeping features, with personalised training from a Notch Above Bookkeeping Certified Xero professional. Book personalised Xero training »

Related reading

https://notchabove.com.au/category/quick-xero-tips/

Source: https://blog.xero.com/data-insights/xsbi-small-business-labour-productivity/