Invoicing is an important part of small business accounting. But the payment process will always be problematic if you don’t set up your invoices properly. So what can you do to ensure that invoicing is easy and your customers pay promptly and regularly?

Take the time to invoice properly

There’s much more to invoicing than simply sending out requests for payment. The key is to get your invoicing process right from the start.

It’s likely as a small business owner, you’re short on time, with many other elements of your business to set up, maintain and monitor. But making the effort to get the payment process right at the beginning will pay off in the end – literally. When your invoicing process is efficient and pain free, it’s likely that your cashflow will improve.

Develop the right mindset about getting paid

The majority of small business owners have worked as employees in the past, before deciding to set up their own company. The transition from employee to owner is not just practical and financial – it’s also psychological. In addition to this, if you’re having to now create invoices, you’ll realise how much time it can take to create and send them.

Employees become used to being paid regularly without having to think about it. The money appears in their bank account or they receive a cheque on the date it’s due. They never have to ask for payment – their pay simply arrives.

But business owners have to proactively chase payments – otherwise, they don’t get paid. And for some people, this can be a difficult adjustment to make. Consciously, you know you’re owed the money. But actually asking for it can feel daunting and stressful.

It’s common for small business owners to initially feel cowed into a feeling of subservience when it comes to asking for payment – particularly in dealings with larger organisations. But the fact is, they have taken your time and/or your product. This means they have a legal and moral duty to pay you according to the agreed terms.

So don’t be meek – be polite but firm. Your clients aren’t doing you a favour by paying. They must pay you, no matter how big or small they are.

Keep accurate records of your work

You can’t invoice if you don’t have accurate records of the work you’ve done for your customers. Keep track of the time and materials expended on a client’s project and make sure you invoice for everything!

Use time-tracking software and time-sheets if you need to record the number of hours or days spent on a project. Be sure to record all Bills of Materials too. Some software will handle this for you.

If you record the work done as you go, it will save you having to remember the details at a later date. It also means you’ll be less likely to forget to include something in your invoice.

Work out how regularly you want to invoice

Should you invoice regular clients on a monthly, fortnightly or weekly basis? It might depend on the type of work being done. For example, services contract work could be invoiced on a weekly basis, while a manufacturing project may be invoiced fortnightly or monthly. This is something to negotiate with your client.

However, be wary if a client insists on an invoicing interval longer than than a month. Unless the circumstances clearly justify it, that may mean they have cashflow issues.

Work out what your accepted payment methods will be

While some payment methods mean extra fees for your business, you should balance the costs against the ease of payment for your customers.

As a general rule, when you make it easier for your customers to pay, it will encourage them to pay sooner – and that’s always a good outcome. For example, some accounting software will add a ‘Pay now’ option to online invoices if you’ve integrated a payment service like PayPal. This means that you can send customers invoices online with the option of getting paid instantly.

It’s possible to differentiate yourself further by accepting new crypto-currencies like Bitcoin and other alternative methods of internet money transfer. However, at the moment it seems that many businesses doing this are more interested in the publicity than the practicalities. The exchange rate to ‘real’ currencies can be wildly variable.

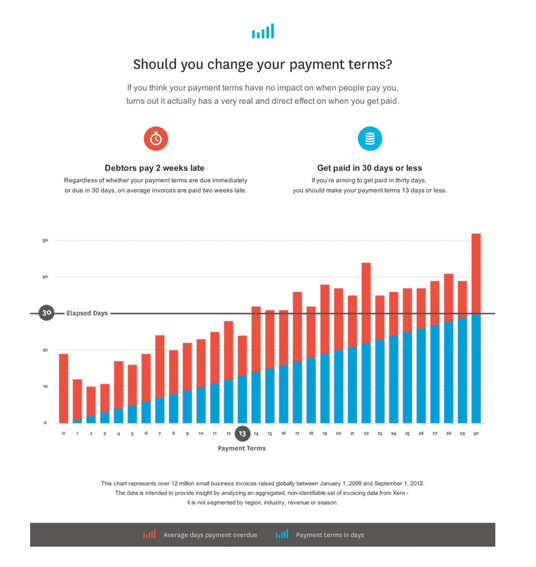

Clearly define your payment terms

Make sure you define your invoice payment terms clearly on all invoices, for example “14 days from date of invoice” or similar. Put the actual due date for payment on the invoice too. Don’t leave your clients to calculate when 14 days from the 23rd February happens to be.

You can remind them of penalties for late payment and let them know exactly how much more it will cost if the payment isn’t on time.

But often a more effective approach, is to offer a small discount for early payment. This sounds more positive and your clients are likely to respond more quickly.

Be human when you invoice

It seems like a small gesture, but often talking to the people in the accounts departments of the companies you’re invoicing can make a difference. All it takes is a polite phone call to introduce yourself as the primary contact for payment matters.

This will often achieve much more than bland emails sent to people who don’t know who you are. A small investment of your time talking to the people who make the payments could prove invaluable to you. It may also help smooth out any payment problems that arise in the future, and it might even get you more work.

Invoice as soon as the work is done

It might sound silly, but some companies forget to invoice for smaller jobs due to the pressure of work and being short on time. They may also leave it for months and then start going through their records to check what they’re owed.

This is an inefficient way to run a business because it damages cashflow and reduces revenue from work that’s already been completed.

Also, if the invoice date drifts too far from the work that was carried out, your client may have some awkward accounts reconciliation to do. This is because the two events may fall into different tax years. So always invoice promptly, or as soon as the agreed work has been completed.

Invoicing should become a fundamental part of your business operations. Some accounting software will schedule invoices automatically for you, and even create and print them or email them to your clients.

Be taken seriously and create professional-looking invoices

At its most basic, an invoice is a written demand for payment. In theory it could contain nothing more than your company’s name and address and the amount owed. In practice you should include much more information than that if you want your business to be taken seriously.

Keep track of late payers

Once invoices have been issued, keep track of who’s paid and who hasn’t. Chase the ones who haven’t, though again it’s usually best to do this politely.

Good accounting software can provide ageing reports that will break down what you’re owed in order of age of invoice, showing you at a glance who owes you money and how much. It may also let you send emails to the slowest payers, so you can remind them of your payment terms and the due date. Some accounting software will also show you when your customer opened the invoice online. Customers won’t be able to pretend they haven’t received your invoice when you can see they opened it weeks ago!

Break down large jobs into smaller invoices

If you’re working on a project that involves a significant amount of your company’s time and/or expenditure in materials costs, it’s worth invoicing in chunks. As an example, you could do one-third up-front, one-third halfway through the job and one-third on completion.

You can negotiate with your client to decide on deposit and balance payments that suit you both. That way, if your customer runs into financial problems part way through the project, you won’t lose everything they owe you, or all the time and money you’ve spent doing the work.

Get the process humming, and you’ll get paid faster

This might all seem like a lot to think about. But once your invoicing process is properly set up, it should run smoothly and without too much intervention.

A combination of the right attitude, processes and accounting software will help you to invoice your clients properly, and encourage them to pay you on time.

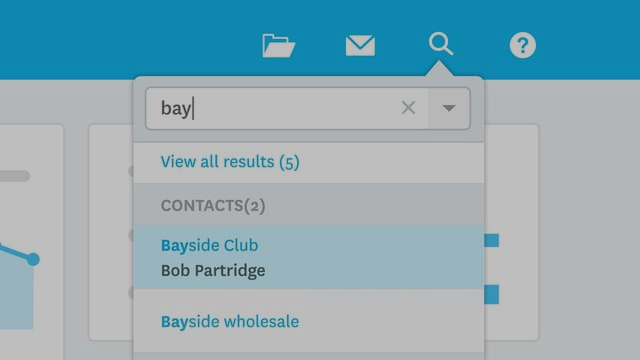

Specialising in Xero bookkeeping, Notch Above is a Brisbane bookkeeper and BAS Agent located in Alderley that offers Xero setup, as well as training and ongoing support. Notch Above can take care of all the bookkeeping tasks you would rather not do, like bank reconciliations, supplier payments, payroll services, debtor control and BAS returns.

Xero and Notch Above Bookkeeping have joined forces to offer 6 months free Xero subscriptions for new Xero files set up by Notch Above Bookkeeping. (Valued up to $540) Limited numbers apply so enquire today – life@notchabove.com.au. You too can then ensure your invoice process is streamlined.