How automated payments can improve your competitive advantage

If you’ve been following our blog for a while, you will be well on your way to developing some strategies to improve the way you do business so that you can increase your cash flow and ultimately your profits – great! You already know that automated payments can help you to get paid faster, decrease the cost of doing business and improve your internal business efficiencies. Obviously this is all great news for extracting the maximum value out of your internal business processes and improving your business’ cash flow position, but did you know that automated payments could affect how your business performs alongside external forces as well?

The fact is, implementing the right automated payments solution to reduce administration time and increase your cash flow translates to a massive competitive advantage for your business on a much larger scale – here’s how.

Automated payments are the default option for the bigger players

People are already using direct debit to pay for their gym membership, insurance, phone bill, internet, childcare and more. This means your customers are highly likely to welcome the convenience of paying you by direct debit as well. Shifting your customers onto smaller more manageable payments, paid automatically by direct debit, will be good for your cash flow, could potentially reduce the perceived total cost of your product or service in your customers’ minds and will give you another tool to help you to compete with the bigger players.

Automated payments make it easy for your customers to buy from you

To succeed in today’s highly competitive post-GFC business environment, you need to implement astute business management processes into all areas of your business – particularly those processes that relate to your inbound cash flow. One sure strategy to maintaining your competitive advantage (without resorting to decreasing your prices) is to make it easy for your customers to buy from you.

Mobile technology means your customer could be doing business with you while they’re picking up the kids from school, having lunch or working out at the gym. The customer transaction landscape has changed and you need to change with it. If you can’t offer the convenient payment options that your customers want (such as direct debit or BPAY), it’s you who will ultimately pay the price of lost customers.

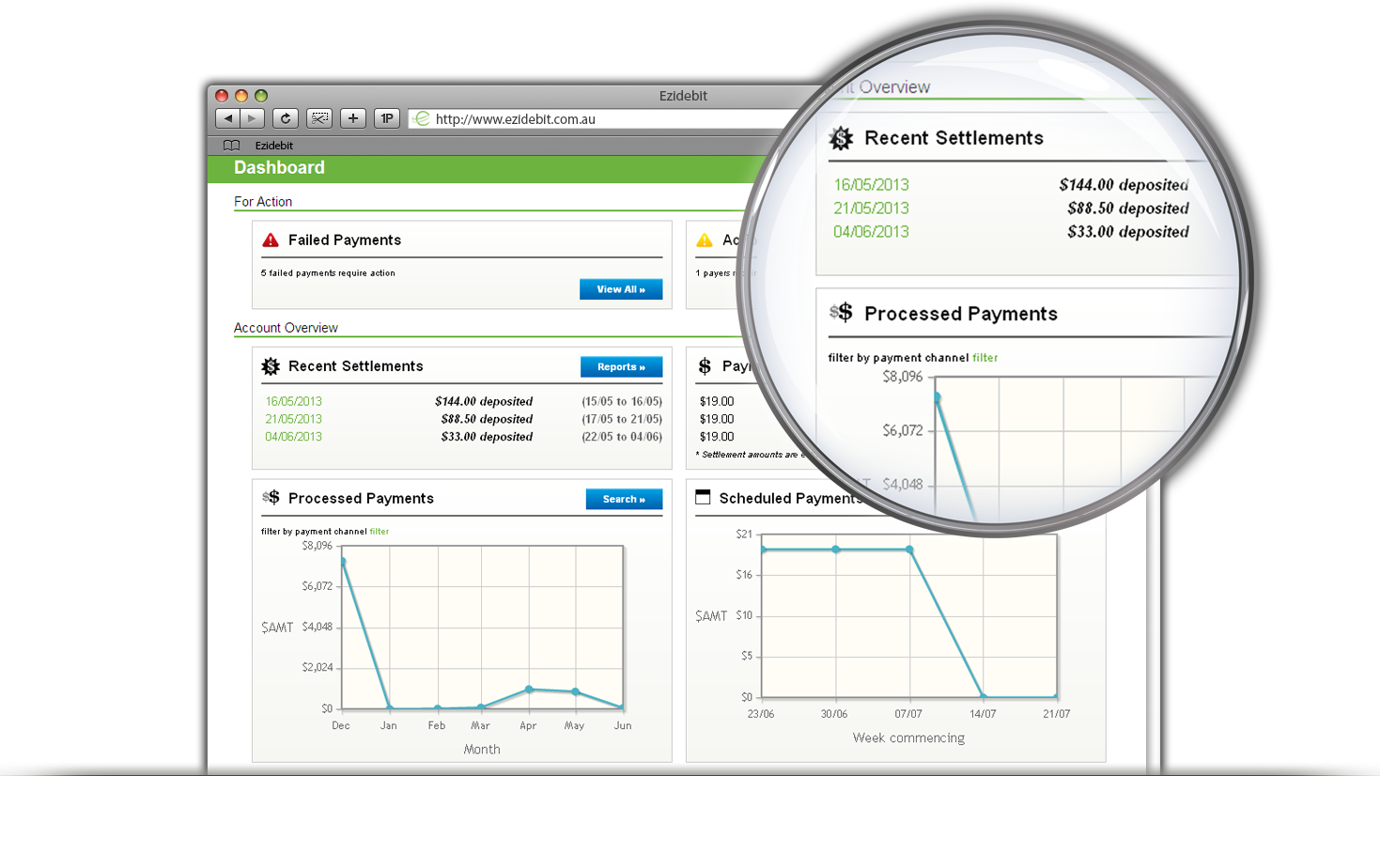

Automated payments software yields fast ROI

The time it takes you to find and implement the right automated payments solution for your business will be an astute investment – in fact, many businesses realise their return on investment in the first month after switching to automated payments.

If you’ve ever benchmarked how much time your team members are really putting into manually processing your customers’ payments (for help on how to do this, read this article on how to reduce the price of payments administration in your business) chances are you’ve already uncovered the real hidden cost of manual payments administration for your business AND set yourself some measurable goals around reducing this time – great!

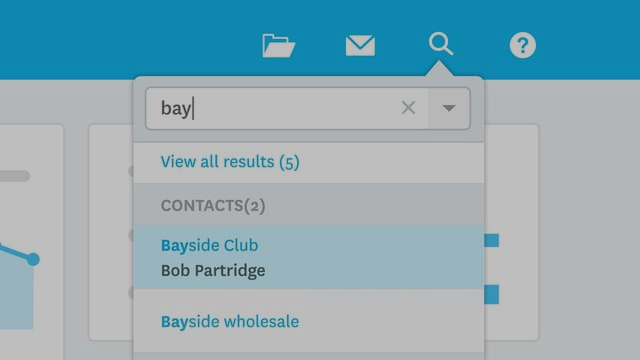

Your next step is to find and implement the perfect automated payments solution for your business – an easy-to-implement solution that will enable you to achieve your efficiency goals by automating your most repetitive manual tasks and removing any tasks that are unnecessarily duplicated – so you can start yielding that return on investment sooner.

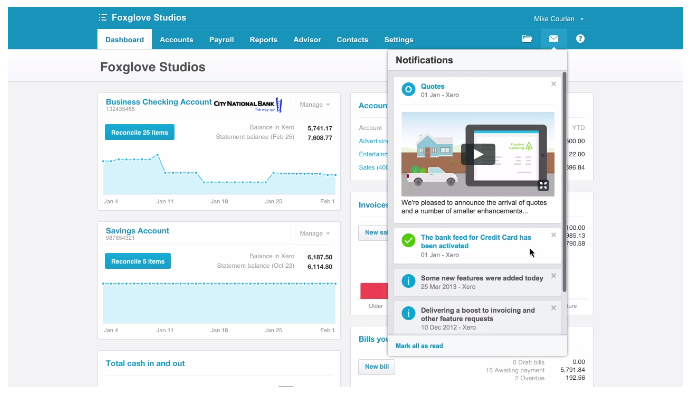

Big benefits and easy to use

If you were to implement the right automated payments solution into your business today, everybody across your business would start to reap the benefits immediately. Your staff will appreciate their reduced manual administration workload and your customers will welcome the offer of more convenient payment options.

To find out just how easy automated payments software can be to use, call us now to discuss.

Specialising in Xero bookkeeping, Notch Above is a Brisbane bookkeeper and BAS Agent located in Alderley that offers Xero setup, as well as training and ongoing support. Notch Above can take care of all the bookkeeping tasks you would rather not do, like bank reconciliations, supplier payments, payroll services, debtor control and BAS returns.

Thanks to Ezidebit for providing this article.