Posts

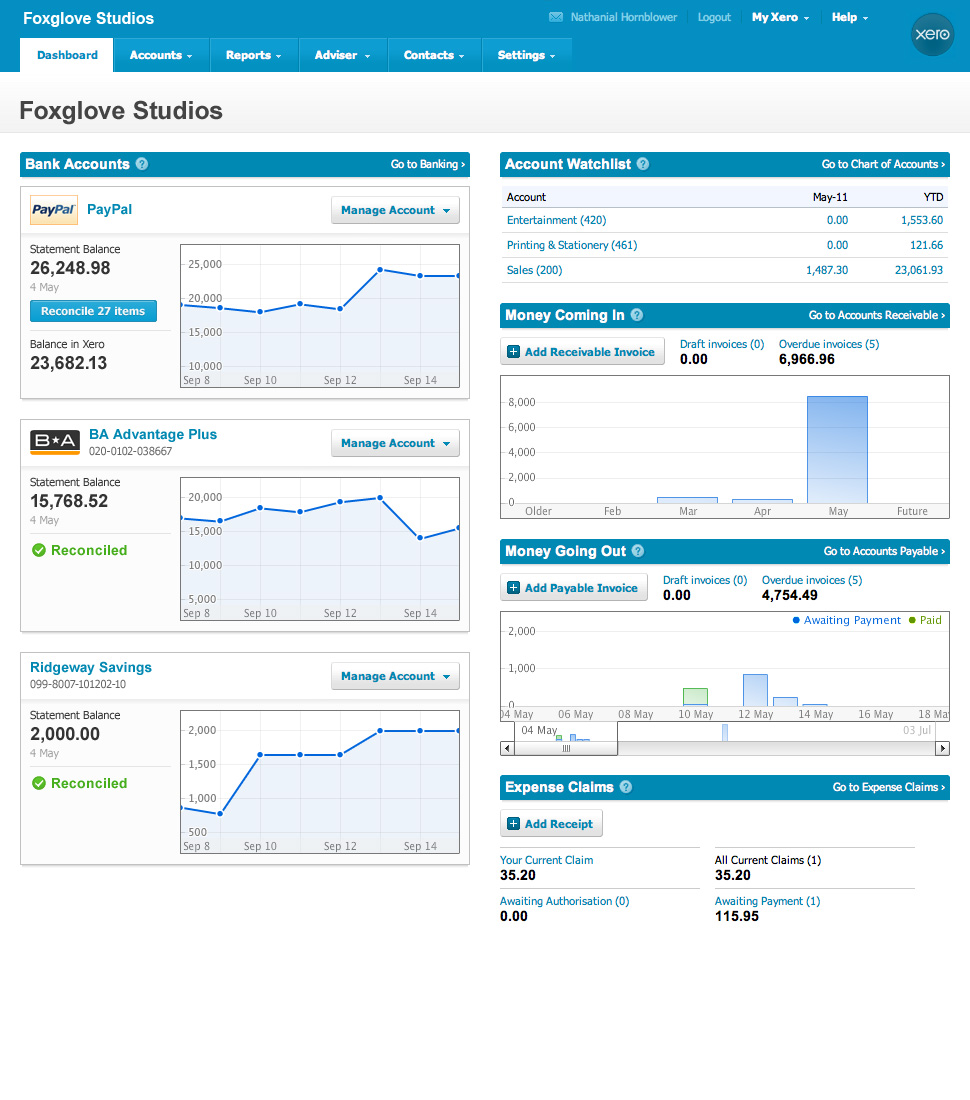

5 tips for Xero users

Here are five useful tips from this year’s Xero quarterly product updates to make you more efficient when using Xero.

STP Phase 2 reporting

We’ve noticed some mistakes businesses are making as we move to STP Phase 2 reporting and are sharing the most common ones so you can avoid them.

Minimum wage increase for some awards from 1 October 2022

Minimum wages in 10 awards in the aviation, tourism and hospitality sectors increase from 1 October 2022.

Superannuation Guarantee changes

From July the SG eligibility threshold changed. Find out how to ensure your payroll systems correctly calculate new SG entitlements.

Single Touch Payroll changes 2022

Everthing employers need to know about Single Touch Payroll (STP) Phase 2 reporting requirements and digital service payroll provider deferrals.

Australian financial year calendar FY22

A lot of things need to happen between the end of financial year (EOFY) and tax time. Here are the dates and deadlines to keep in mind when getting tax ready.

Prepare Payroll for year end

With the end of the financial year approaching, follow these steps to ensure that your payroll and payroll summaries are in order.

The basics of EOFY

The end of the financial year or EOFY, is a time where your business has to submit a tax return based on your income and expenses. We break down some common terminology

EOFY resources for small business

Get help with tidying up the books and wrapping up the accounts this end of financial year (EOFY) with these resources for your small business.