A Look into Xero Invoicing Updates

Xero has announced that they will be retiring the older version of their invoicing product from September 2024.

CSIRO ‘Innovate to Grow’ program

‘Innovate to Grow’ is a free, 10-week program assisting Australian SMEs to explore and use R&D for growth in advanced manufacturing solutions. Applications close on 12 May 2024.

New rules for fixed term contracts

From December 2023, there have been substantial changes in the usage of fixed term contracts.

Employer gender pay gaps published

The 2022-2023 WGEA report reveals sizeable gender pay gaps, highlighting the need for action. Mandatory reporting aims to address the disparities.

Changes in the Small Business Super Clearing House

Given the proximity of the next SG contribution deadline on 28 April 2024, it is important to take action ahead of this date to prevent potential compliance issues.

Get Set for Significant Changes from January 2024

From 1 January 2024, several changes have been implemented, bringing a mix of positive and negative impacts for various segments of the population.

GST and using or receiving digital currency

Are you using digital currency to pay for goods and services or accepting it as payment in your GST-registered business? If so, it’s just like using money and the normal GST rules apply.

AI Adopt funding program

Funding is open for Artificial Intelligence (AI) Centres to help SMEs adopt AI technologies. Applications close 29 January 2024.

Christmas parties and gifts

In this article we share the ATO's intricacies around Fringe Benefits Tax (FBT) regulations for business Christmas parties and gifts.

QR Quishing Scams

Scammers turn to QR codes as banks warn of the Christmas dangers of 'quishing'.

7 Ways Businesses can avoid Cyber Fraud

Businesses face increased financial risk as cyber-criminals get more sophisticated. So, what can you do to protect yourself against financial fraud? Here are some guidelines.

QLD Digital Solutions Program

Get up to 4 hours of mentoring support, including the development of a tailored Digital Action Plan, subsidised through the Digital Solutions program.

Qld businesses save with new energy efficiency rebates

Rebates available for energy-efficient appliances and equipment to help small-to-medium Qld businesses reduce electricity consumption and costs.

Qld Workforce Connect Fund

Through the Workforce Connect Fund, Qld small businesses can apply for an HR Support Grant of up to $5,000 to implement new and innovative HR solutions to address an immediate need.

QLD Ignite Spark Funding closing soon

The Ignite Spark Program aims to support Queensland-based small to medium-sized innovation-driven enterprises with high-growth potential to progress the development of an innovative product or service closer to market.

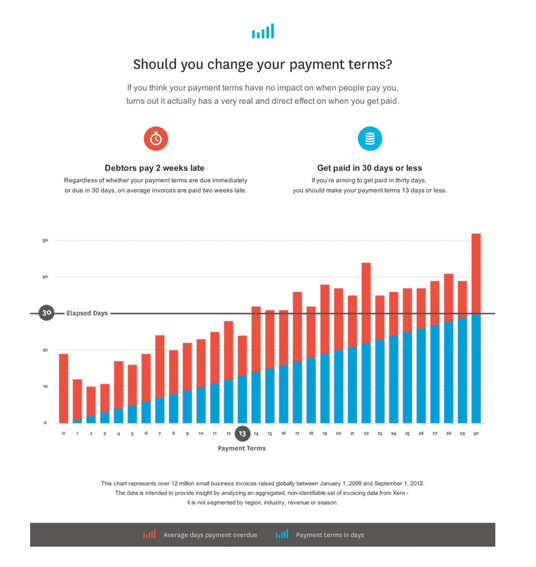

Getting paid on time

Businesses thrive when the cash position is healthy — let's look at some Best Practices in the area of Accounts Receivable aka Collections.

Navigating Artificial Intelligence

With AI tools becoming more easily accessible, small business owners want to be proactive and stay ahead of the curve.

Another $2.5M in grants for QLD small businesses

Business Boost grants of up to $20,000 to help Queensland businesses are up for grabs with $2.5 million available in this round. Applications close 12 September 2023.

Xero Beautiful Business Fund submissions now open

Xero small business customers have until 6 October 2023 to enter to receive a share of $750k in funding globally.

Apply for Xero Beautiful Business Fund

Xero has announced the launch of their Beautiful Business Fund, an initiative backing business for the future with a share of funding available to Xero customers so your business can keep doing what it does best. Register now.

Reviewing Costs to Increase Cash and Drive Profits

All businesses should review their expenses periodically. Prudent expense management helps ensure that valuable cash resources are used wisely. No matter what the circumstances, here are some Best Practices in reviewing and managing expenses.

1 July Changes

There are legal, financial and other changes your business will have to be across right now. Not sure what they are or what to do? Don’t worry, we outline the key ones here.

Goal setting

It can take time to get clear on goals but the business benefits of goal setting can be substantial.

Payday super proposed

From July 2026, employers will be required to pay super for their employees at the same time as their salary and wages.

Moving to new Xero Reports

Xero will be transitioning some favourite ‘starred’ reports from the old version to the new version. The new versions offer more flexibility and customisation, quicker access to insights and deeper analysis of business performance.

Google’s April 2023 Reviews Update

Google's April 2023 Reviews Update will have a significant impact on businesses that rely on online reviews to attract customers. To ensure that your business continues to be visible in search results, read the key points here.

Super guarantee rate change scheduled

With another Super Guarantee rate increase scheduled on 1 July, employers are reminded to update their payroll system to align with these changes.

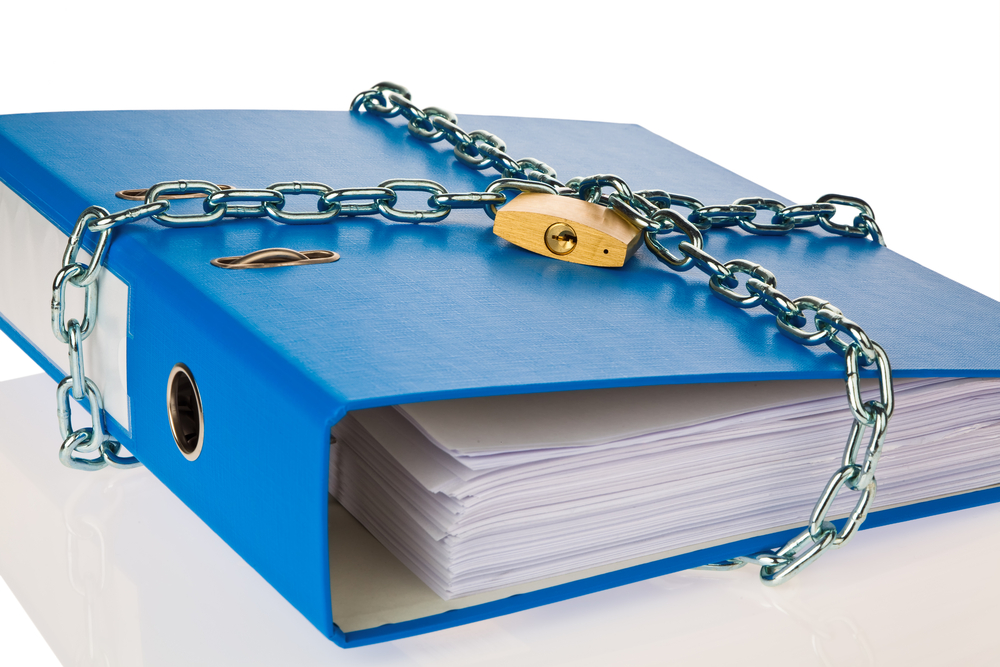

Cybersecurity strategy — patching operating systems

Just like fixing a broken lock, updating your operating system is a small but critical step in keeping your digital environment secure.

Federal Budget 2023-24

The Federal Government has handed down its 2023-24 Budget which outlines its economic forecasts and identifies key priorities including cost of living relief and growing the economy.

Using KPIs to Drive Management Decisions

Do you need to develop and understand the role of Key Performance Indicators in your business? Not sure where to start? Here are some tips!

Cybersafety and configuring macro settings

Macros in Microsoft Office applications are a great way to automate and simplify day-to-day tasks, but they can also be a security risk if they're not checked and maintained regularly.

Cybersafety strategy for user application hardening

Would you know how to harden your OS? What about how to test if your operating environment is secure? These are some of the questions to consider when protecting your operating system against attacks.

CSIRO aids SMEs in advancing cybersecurity and digital tech R&D

The CSIRO is helping small to medium enterprises enhance their research and development knowledge with a free 10-week online program focused on cybersecurity and digital technologies.

Project Trust Accounts for QLD Tradies

The Queensland Government has announced an extension of the commencement date for eligible contracts under the Project Trust Accounts (PTA) framework, providing further security of payment for tradies.

10 Tips on Onboarding Remote Employees

Remote employment presents challenges which means helping employees quickly become comfortable, engaged and productive. Here's how to make your onboarding process a success.

ATO Make cyber security a priority for 2023

Read why business owners hold the keys to their customers' lives on their devices and are responsible for keeping that information safe from cybercriminals.

Expanding Single Touch Payroll Phase 2

Single Touch Payroll Phase 2 will streamline employers reporting payroll information about their employees to government agencies.

Energy Efficiency Grants for SMBs

Funding to purchase energy-efficient equipment upgrades for small and medium businesses is available now. Applications close 19 April 2023.

Overview of Crisis Management for Business Leaders

How ready is your business to deal with a business crisis? We look at what can be done to reduce risk and manage business crises effectively.

Automating Your Business

Automation is not a new idea but the opportunities to automate continue to grow all the time. We look at some business areas where automation has proved to be particularly impactful.

4 Priorities for Successful Businesses in 2023

What’s your business strategy for next year? We got together with a group of high-performing businesses to discuss their priorities, especially the ‘big picture’, strategic ideas. Here’s the list we came up with!

5 tips for Xero users

Here are five useful tips from this year’s Xero quarterly product updates to make you more efficient when using Xero.

Attracting talent to your workplace

Having trouble attracting talent to your workplace? Here are 7 ways to distinguish your business in a competitive hiring environment.

Getting employees on board for the holiday rush?

Hiring additional employees to help with surging end-of-year demand? The New employment form, accessed through ATO online services, will help reduce employer admin.

Do you think you can spot a cyber threat?

Cyber security is more important than ever. Protecting your customers and your data from cybercriminals should be one of your top business priorities.

Wellbeing for small business owners

The Queensland government has unveiled an $8.76 million wellbeing package for small business owners in need of mental health support.

Made in Queensland

Made in Queensland is a State Government program helping small and medium-sized manufacturers to increase international competitiveness, productivity and innovation. Round 5 closes 12 Dec 2022.

8 Best Practices in Delegation

The art of delegation has been studied at length by prominent thinkers such as Dr Stephen Covey and others. Here are some ideas that may apply to delegation in your business.

STP Phase 2 reporting

We’ve noticed some mistakes businesses are making as we move to STP Phase 2 reporting and are sharing the most common ones so you can avoid them.

Protect yourself and your business online

Throughout October the Australian Cyber Security Centre (ACSC) is sharing guides and resources that will help you protect all your information from cyber criminals.

Minimum wage increase for some awards from 1 October 2022

Minimum wages in 10 awards in the aviation, tourism and hospitality sectors increase from 1 October 2022.

Digital Solutions for small business

Read how the Digital Solutions program works with you to adopt digital tools to save you time, money and help grow your business.

Regional Futures – Collaborative Projects QLD

Funding for regional Queensland collaborations is available to solve significant innovation challenges within the state.

ASCS warns of increasing ransomware attacks

The Australian Cyber Security Centre has released an updated Ransomware Prevention Guide providing steps you can take to protect your business from cybercriminals.

3 ways eInvoicing helps small business

Australia’s innovative small businesses are increasingly recognising the value of eInvoicing – the digital alternative to paper. Read why.

Superannuation Guarantee changes

From July the SG eligibility threshold changed. Find out how to ensure your payroll systems correctly calculate new SG entitlements.

Businesses urged to safeguard digital identities

Time is running out for businesses to secure the latest .au domain name resource and prevent an unrelated party setting up shop at the internet’s latest address.

Single Touch Payroll changes 2022

Everthing employers need to know about Single Touch Payroll (STP) Phase 2 reporting requirements and digital service payroll provider deferrals.

Complete tasks for your tax period

Financial year end is the perfect time to do a check-up, celebrate your successes, and refocus on business goals.

Australian financial year calendar FY22

A lot of things need to happen between the end of financial year (EOFY) and tax time. Here are the dates and deadlines to keep in mind when getting tax ready.

Prepare Payroll for year end

With the end of the financial year approaching, follow these steps to ensure that your payroll and payroll summaries are in order.

Complete tasks for your tax period

Use your time wisely to help give you the space to start analysing how your business is tracking and really focus on the growth opportunities available.

The basics of EOFY

The end of the financial year or EOFY, is a time where your business has to submit a tax return based on your income and expenses. We break down some common terminology

QLD flooding assistance extended

Low-interest loans are available for small businesses and primary producers in local government areas facing a massive clean-up operation in the aftermath of the flooding in Southern Queensland.

EOFY resources for small business

Get help with tidying up the books and wrapping up the accounts this end of financial year (EOFY) with these resources for your small business.

Brisbane Suburban Shopfront Improvement Grants

Suburban Shopfront Improvement Grants provide up to $5000 to property owners or tenants in local business precincts to bring a fresh new look to their shopfronts.

Disaster assistance for latest QLD flood event

Queenslanders impacted by floods can now register to access additional support from the DRFA and the Resilient Homes Fund.

Employer guide to family and domestic violence

As an employer, you need to know that the Fair Work Act now provides minimum entitlements for employees around family and domestic violence.

Digital and Skills Tax Boost for Small Businesses

The Government is delivering $1.6 billion in tax relief to support small businesses to go digital and upskill their employees.

Grants for bank customers impacted by floods

The Big 4 banks have pledged support for New South Wales and Queensland customers impacted by flooding by granting financial assistance in the form of relief packages.

Struggling to go green?

While no single business or organisation has all the answers, what everyone can do is take action by making reductions to their carbon footprint.

Australian Government Disaster Recovery Payment for NSW, QLD flood victims

Residents in 26 flood-affected LGAs across Queensland and NSW can apply for AGDRP financial support via Services Australia from 1 March.

QLD Emergency hardship assistance

Emergency hardship assistance is available to eligible applicants who may receive $180 per person up to $900 for a family of 5 or more. The grant is initially available to claim for 7 days following the activation of the grant in your area.

2020 Notch Above Bookkeeping

2020 Notch Above BookkeepingManaging business cash flow and income

While 2022 will hopefully be a year of rebounding sales and revenue, business owners need that to carry through to the bottom line. Here are 4 steps to help support that recovery.

Fuel tax credit latest rates

The ATO's fuel tax credit calculator includes the latest rates and is simple, quick and easy to use. You can use it to work out the fuel tax credit amount to report on your business activity statement (BAS).

February 2022 cryptocurrency scam

Scammers pretending to be from the ATO are telling people they are suspected of being involved in cryptocurrency tax evasion.

Business sustainability

According to a study commissioned by Xero, 68% of small businesses want to improve their sustainability practices.

Xero’s small business trends report 2022

After two challenging years, small businesses may be eyeing a cautious recovery going into 2022.

2020 Notch Above Bookkeeping

2020 Notch Above BookkeepingManage your business cash flow

A cash flow budget or projection, and having enough cash at the right time, makes it easier for business owners to pay bills and other expenses and meet tax, super and employer obligations.

Preparing for the holiday season

Small business owners: Don’t wait to prepare for the holiday season. Here are some tips to get ahead of the holiday rush.

NSW Summer Holiday Stock Guarantee

As part of the Economic Recovery Strategy, the NSW Government has committed to provide a Summer Holiday Stock Guarantee grant for Small and Medium Enterprises.

Increased penalty rates for casual hair and beauty weekend workers

Fair Work Australia has announced increased penalty rates for casual hair and beauty workers on weekends, to begin in January and be phased in over two years.

Stapled super funds start this month

From 1 Nov 2021, if you have new employees start, employers may have an extra step to comply with choice of fund rules.

Data privacy statistics

The majority of Australian small businesses are inadequately prepared for sweeping changes to the Commonwealth Privacy Act, according to new research from global technology platform, Zoho.

2020 Notch Above Bookkeeping

2020 Notch Above BookkeepingE-invoicing an easier way to invoice

41 Comments

/

E-invoicing is a way to exchange invoices with other businesses that removes the hard parts and makes the whole process faster, more secure and more efficient.

Director identification numbers

Director identification numbers (director ID) are a new requirement for all company directors, designed to help combat illegal activity by making it easier to trace directors’ relationships with companies. Company directors have been given 12 months to apply.

Stapled super funds

From 1 November, if any new employees start, the employer may have an extra step to comply with the choice of super fund rules.

Westpac encourages Australians to be alert as scam activity peaks during COVID-19

According to a new study, more than 1.2 million Australians have been scammed in the last 12 months, with people under 30 being twice more likely to have been targeted during Covid-19.

ATO Payment Plans

Did you know that the Australian Taxation Office (ATO), one of the biggest creditors to small business, allows payment of tax debt by instalments as an option?

NewAccess for Small Business Owners

NewAccess for Small Business Owners is a free and confidential mental health coaching program, developed by Beyond Blue to give small business owners, including sole traders the support they need.

Accounting 101: Cost Of Goods Sold (COGS)

Cost Of Goods Sold (COGS) refers to the cost of producing an item or service sold by a business. Here's why knowing your COGS is important.

Minimum Wage Rate 2.5% increase

The Queensland Industrial Relations Commission announced its decision to increase the Queensland minimum wage by 2.5% effective on and from 1 September 2021.

Australian SMBs record strongest sales growth in June

A study revealed that Australian small businesses enjoyed their best sales in June 2021, ahead of the latest COVID-19 restrictions in New South Wales, Victoria, and South Australia.

QLD COVID-19 Business Support Grants

Your business or not for profit organisation may be eligible for financial support through the 2021 COVID-19 Business Support Grants, if it has been affected by the August 2021 COVID-19 lockdowns in Queensland.

The Evolving Role of Leadership

How are the leaders in your business doing? We look at some leadership skills which are proving to be really valuable as businesses find a path forward this year and beyond.

https://notchabove.com.au/wp-content/uploads/2021/08/cozy-winter-read-tablet-ipad.png

788

940

Notch Above Bookkeeping

https://notchabove.com.au/wp-content/uploads/2017/09/Notch-Above-Bookkeeping-Service-Brisbane-Logo-300x136.jpg

Notch Above Bookkeeping2021-08-09 17:17:492021-08-02 17:28:39Cocooning

https://notchabove.com.au/wp-content/uploads/2021/08/cozy-winter-read-tablet-ipad.png

788

940

Notch Above Bookkeeping

https://notchabove.com.au/wp-content/uploads/2017/09/Notch-Above-Bookkeeping-Service-Brisbane-Logo-300x136.jpg

Notch Above Bookkeeping2021-08-09 17:17:492021-08-02 17:28:39Cocooning

STP Phase 2 starts January 2022

Single Touch Payroll (STP) Phase 2 reporting starts 1 January 2022; learn what it means for employers.

4 Start Up Tips for Budding Entrepreneurs

Starting your own business can feel like you’re in a pressure cooker with newfound worry about when the next dollar will land in your bank account. However there are some solid steps that owners of start-ups can take from Day 1 to keep finances in check and make what should be an exciting process less daunting.

Your Financial Literacy

Accurate financial reporting is key to understanding the true position of your business in order to make informed decisions.

Employment Contract Tool

The Government has launched a new online tool for small business owners to build your own employment contract for an employee under Australia's Fair Work System that is tailored to your business needs.

Superannuation guarantee increase on 1 July

An SG base rate rise is set from 1 July which will increase from 9.5% to 10%, followed by incremental half percentage point increases each year to 12% on 1 July 2025.

Single Touch Payroll changes

From 1 July 2021, most small businesses will need to be STP compliant. This includes small employers with closely held payees, as well as some microbusinesses and seasonal employers.

Top Xero time saving tips

If you are short on time, take a peek at a few Xero time-saving timesaver tips to help you run your business more efficiently.

2020 Notch Above Bookkeeping

2020 Notch Above BookkeepingIs your business analysing the rise in data to better understand customers?

Is your business collecting data that helps you understand your customers better? Are you putting it to use when you engage with them? If the answer is ‘no’, you’re already behind the eight ball — read why.

Digital bookkeeping for business

At Notch Above Bookkeeping, our team is passionate and committed to working with business owners to get their bookkeeping on track — via the cloud. Whilst we're adjusting to a new world post-COVID, there's every reason to embrace a more streamlined, efficient approach to business bookkeeping.

Switch now to Online services for business

The ATO's Business Portal will close soon so make the switch to Online services for business today! To access Online services for business, go to ato.gov.au/OSB.

2021 Australian Accounting Awards

Notch Above Bookkeeping has been named a finalist in the 2021 Australian Accounting Awards for Bookkeeping Firm of the Year!

Winning and keeping talent

If you’re a small business owner, here are four ways to set yourself apart as a top employer to win and keep your employee talent.

Knowing your financials is vital for success in 2021

More than ever, businesses need to understand and manage their finances to navigate the new terrain of 2021, not just to survive but thrive.

Xero Verify Multi-Factor Authentication

To make sure your Xero account continues to be secure, Xero is making Multi-Factor Authentication (MFA) mandatory for all Xero customers globally in the year ahead.

Top tips to get your books in shape for year-end

The financial year-end can be a stressful time for small businesses that don’t have their bookkeeping in order. But it doesn’t have to be.

Cut costs or continue spending?

With the economy in recession, many businesses have faced the challenge of re-evaluating how they operate One of the most difficult decisions is whether to cut costs or continue spending. But which of these activities could help increase your profits to build a more resilient business?

Be your best tradie with the right tech

How can tradespeople go about streamlining their business and help set themselves up for success? We look at 2 simple ideas.

Tips for Maintaining and Managing Good Cash Flow

Read why having adequate working capital at all times is really important, and managing this capital carefully is critical.

Notch Above Medical and Healthcare bookkeeping

Transform your clinic’s bookkeeping and free up your time with bookkeeping solutions for medical and healthcare practices by Notch Above, powered by Xero Cloud Bookkeeping.

Cost control measures

Effective cost control measures are crucial to cash flow for running a sustainable business at any time – but even more so during periods of economic uncertainty.

Reduce Business Operating Costs

Every business owner – no matter how big or small their business – wants to reduce their operating costs. And it’s not impossible. Here are eight strategies that’ll not only save you money, but improve the efficiency of your business.

Positioning products with risk in mind

Understanding current attitudes to risk will help you to position your products perfectly. Read how.

Understand customer mindset to respond to buying patterns

As the government restrictions to protect our health eventually ease, people will adapt to the changes at different speeds. Those variations will, in turn, have big impacts on sales for small businesses. How do business owners respond?

Distributed work

The COVID19 pandemic has spurred the speedy adoption of digital technologies, including cloud-based file storage and workplace collaboration apps. These tools have turned living rooms into home offices almost overnight, as we learn how to be productive away from the workplace.

Future proof your small business with cloud technology

A new study explores the impact of COVID-19 on small businesses, and identifies some strategies that have proven successful in helping small businesses survive and even thrive.

Your wellbeing in 2021

Read why some people are labelling 2020 as the ‘great pause’ because it has given us more time with family, less time at the workplace, and more time to relax.

Buy local first this festive season

Find out why broadening your supply chain and buying local dramatically lowers your risk when things get tough.

Continuity planning

While we work through the current challenges facing our businesses, it’s a good idea to also keep an eye on future goals and the risks on the horizon. That’s where a business continuity plan can help.

Watch out for online shopping scams this holiday season

Losses to online shopping scams have increased 42 per cent this year and Scamwatch is warning Australians to be careful when buying gifts this holiday season.

Business health front and centre

In the wake of the COVID-19 pandemic, read how keeping health front of mind in every transaction will help make things more comfortable for your customers.

Can Christmas parties go ahead during the coronavirus pandemic?

The office Christmas party might not look the same this year, but it’s still possible to inject some fun into end-of-year celebrations without putting anyone at risk. Read how.

Are you following these cybersecurity basics?

We’ve all heard the cyber security buzzwords – phishing, botnets, malware. You might be thinking, are these real and am I really at risk?

Low contact and cashless

Contactless cards, digital wallets, even tapping your watch – they all bring new levels of convenience that customers have grown to love. Find out why these cashless solutions are popular for an all-important new reason.

Making the move online

Having an online presence has gone from a nice-to-have to a must-have. If ever we doubted the power of the internet, the COVID19 pandemic has confirmed it once and for all. Read why.

Put your own oxygen mask on first

2020 has brought tremendous change and uncertainty on individuals and organisations. Find out why business leaders have a role to play in ensuring their teams feel supported during periods of ongoing change.

Property maintenance business bookkeeping case study

Bookkeeping used to terrify handyman Keith but now he can focus on his customers because Notch Above makes sure that things are correct and we are only a call or email away.

Online bookkeeping change saves time… and trees

Apart from saving reams of paper, Cris has also experienced the time saving of not having to block his time out each quarter to prepare the paperwork for us. Read how.

Know your boosts inside and out

If you've received a cash flow boost, you may be wondering if the amounts you've received affect your income or deductions this tax time. Here are the 4 essentials to know when lodging your tax return.

2020. Notch Above Bookkeeping

2020. Notch Above BookkeepingWho in your business is eligible for JobKeeper?

Did you know that if your business is enrolled for the JobKeeper Payment, you may be able to claim payments for an eligible business participant? Here are the details.

Insurance broker’s bookkeeping now a breeze

Insurance broker now has peace of mind knowing that Notch Above’s bookkeeping processes produce accurate monthly data which is available to her whenever she needs it. It not only helps her in her business decision-making but it also makes for easy end-of-financial-year processing.

Xero File Review Service

Notch Above's Xero File Review Service gives you the peace of mind that your business accounting data is accurate and therefore providing information that enables you to make informed financial decisions to sustain and push your business forward despite COVID-19.

New 1300 number for Notch Above

Notch Above Bookkeeping is pleased to be able to advise of our change in business phone number to 1300 015 130 effective immediately.

Contact your energy retailer to get help in COVID-19

The federal government has outlined new measures as well as extended existing measures alongside the Australian Energy Regulator that require energy companies to extend relief to small businesses struggling through the COVID-19 pandemic.

2020 Notch Above Bookkeeping

2020 Notch Above BookkeepingJobKeeper is changing

It’s good to hear JobKeeper has been extended, with some notable changes. We’ve tried to capture what’s new with the wage-subsidy program in this article.

Returning to work after COVID19

As a business leader, it’s important that everyone on your team feels comfortable about returning to work after remote working during COVID19. Xero has some great tips on this.

2020. Notch Above Bookkeeping

2020. Notch Above BookkeepingJobKeeper 2.0

For businesses to remain eligible for JobKeeper 2.0, your business turnover does get retested each quarter and needs to still show a reduction.

JobKeeper audits underway

Imagine going through the rigmarole to apply for JobKeeper when COVID-19 restrictions were rife, only to find your application rejected months later by Tax Office auditors. That is what happened to one small business who took a DIY approach to their JobKeeper application.

2020 Notch Above Bookkeeping

2020 Notch Above BookkeepingExtension of the JobKeeper Payment

The Government is extending the JobKeeper Payment by a further six months to March 2021. Support will be targeted to businesses and not-for-profits that continue to be significantly impacted by the Coronavirus.

Business advice for a new financial year

Emerging from challenging times, we outline some helpful planning tips for business owners this financial year.

COVID-19 Safe Work Principles

The Australian Government’s framework to create a COVIDSafe society details our new ways of living and working. Designed to keep people safe while returning to greater social freedoms, restrictions are intended to be pared back in three steps.

Notch Above revealed as Accounting Awards Finalist

Notch Above Bookkeeping has been named as a finalist in the Australian Accounting Awards for Bookkeeping Firm of the Year 2020.

Has COVID-19 changed bookkeeping as we know it?

Contact Notch Above Bookkeeping during COVID-19 restrictions to get your bookkeeping system up to date and working more efficiently whilst your employees are making the best of working offsite.

FREE Working from Home ATO factsheet

If you work from home during COVID-19 restrictions, remember to keep records and receipts for your home office expenses, along with a record of the hours you work from home. Keeping good records now will help to get your deductions right at tax time. The ATO has a PDF poster you can download to help understand what you can claim.

Deadline for JobKeeper is extended

If you’re an Australian business applying for JobKeeper, the window to enrol for the subsidy payments from end-March has been extended. You now have an extra month, as the ATO has set a deadline of 31 May.

Superannuation guarantee amnesty

This SG Amnesty law change provides a number of incentives for employers to pay any unpaid historical superannuation guarantee (SG) amounts relating to the period 1 July 1992 to 31 March 2018.

COVID-19 Cash Flow Boost

The Tax Office has announced that the cash flow boosts will be applied to reduce liabilities arising from the same activity statement but will not be offset against existing BAS debt but rather refunded to you.

2020 Notch Above Bookkeeping

2020 Notch Above BookkeepingJobKeeper Enrolments Start Monday 20 April

JobKeeper Enrolments will start on Monday and be open for two weeks for the first payment period. There is a step-by-step process to follow for this scheme which we can do for you to allow you to continue focusing on your business.

JobKeeper – Waiting on Release of Further Details

As you probably are aware the Bill has been passed but as yet we do not have any further details. We believe this information will be released shortly and as soon as we know more can let you know.

Practical Positivity

Stay safe. Do what you can with what you have. Control what’s…

Coronavirus Jobkeeper Payment

The Government has announced a $130 billion JobKeeper payment to help keep more Australians in jobs and support businesses affected by the significant economic impact caused by the Coronavirus.

2019 Small Business Tax Time Toolkit

The ATO's 2019 Small Business Tax Time Toolkit may assist small business owners to complete accurate expense claims, with help and support from Notch Above Bookkeeping.

Going Freelance

With the right understanding of your finances, freelancers can generate a very healthy income from their skills. But to make your microbusiness profitable, you definitely need some sound financial management.

Coronavirus cash flow assistance for business

We will ensure these Coronavirus cash flow business incentives are included in your business BAS returns when lodged with the tax office.

Economic Stimulus Package

The Government has announced a $17.6 billion economic plan to keep Australians in jobs, keep businesses in business and support households and the economy as the world deals with the significant challenges posed by the spread of the coronavirus.

Support measures to assist those affected by COVID-19

The Australian Taxation Office (ATO) will implement a series of administrative measures to assist Australians experiencing financial difficulty as a result of the COVID-19 outbreak.

ReceiptBank Awards 2020

Shortlisted as a Bookkeeping firm who has actively paved the way in the industry, leading by example, working with cloud-based solutions such as general ledgers and Receipt Bank, Notch Above Bookkeeping has been selected as a ReceiptBank Awards Finalist in the Bookkeeping Firm of the Year category!

2019 Small Business Tax Time Toolkit

The ATO's 2019 Small Business Tax Time Toolkit may assist small business owners to complete accurate expense claims, with help and support from Notch Above Bookkeeping.

Australian modern awards changes

If you’re an Australian employer, you may be aware that changes are coming to modern awards that will require added compliance.

Square and Xero enhance integration, POS features

The Xero-Square integration has been enhanced for Australian users. You’ll see several new features.

Integrated quoting in Xero Projects

Now it’s easy to estimate jobs, send and track acceptance of quotes, and track costs back to budget, all within Xero Projects. This results in more accurate quotes, easier invoicing and better visibility of profit on every job.

Fuel up with BP and Xero Connect

Xero now integrates with BP Plus Fuel Card in Australia and the BP Fuelcard in New Zealand, keeping small businesses on the road without the headache of holding onto physical receipts.

Super Guarantee amnesty

Last year’s announcement of an amnesty for employers who come forward to correct underpayments of their super guarantee obligations has been resurrected in a new bill.

Single Touch Payroll deadline passed

While the initial deadline was 1 July 2019, the ATO provided a three-month transition period for employers that needed more time.

Eliminate the time wasters

Before you can identify what activities are adding value to your business, your personal life and, more importantly, what activities are not, you need to know how you actually spends your time.

Notch Above Case Study

Nicole is certainly keeping very busy, but by trying to do it all she is spreading herself too thin and sacrificing her personal life on the altar of her business.

Fundraising isn’t the end-goal

Should a business bootstrap or raise external financing? There is a time and place for either strategy, but what we've noticed is that startups tend to fixate on the latter.

The importance of financial transparency

When pitching a business to investors, getting the right number - whether it's net profit, sales, margins - is key. Read why.

STP transition year for large employers has ended

Single Touch Payroll transition year for large employers has ended. Make sure you are STP reporting or are covered by a deferral as penalties may apply.

Numbers should tell a story

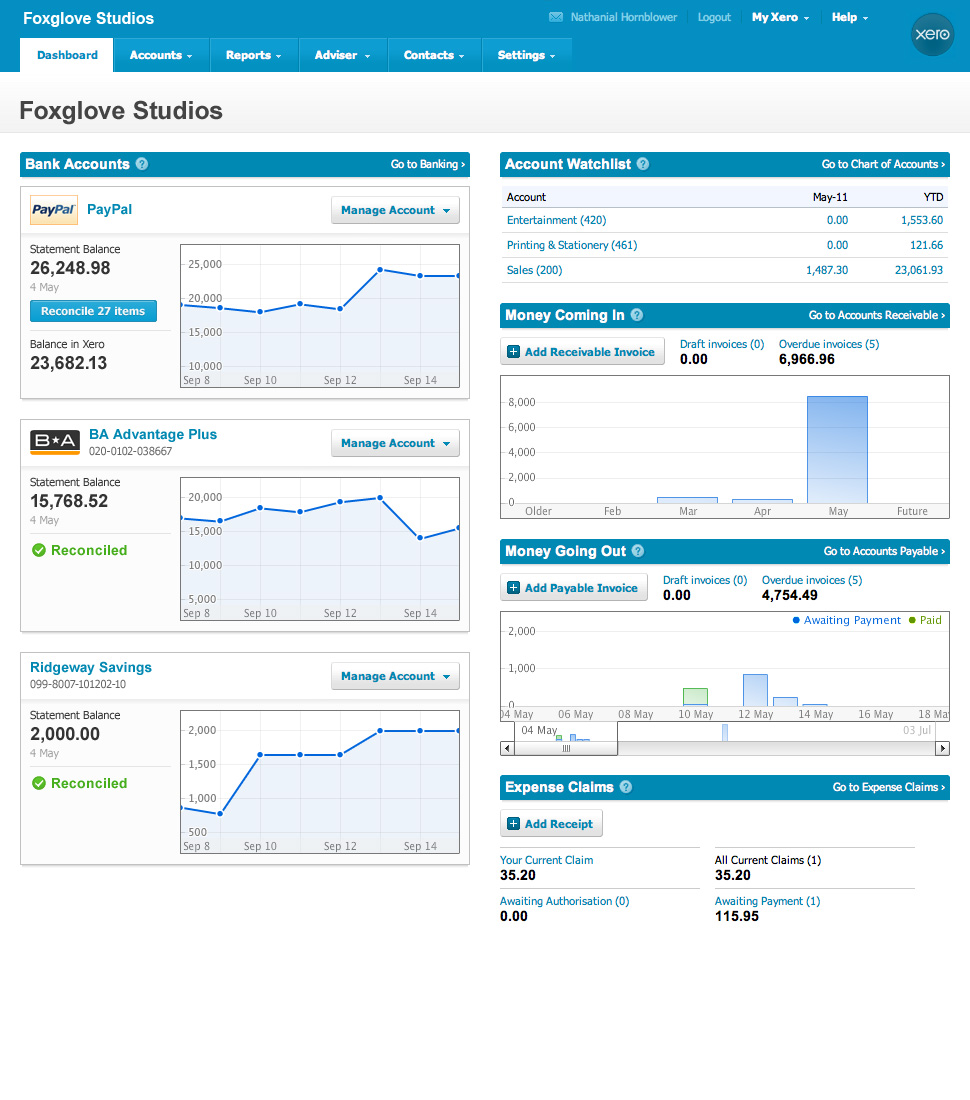

Read why learning to use and understand the powerful reports inside Xero are critical to the overall success of your small business.

Can we help you streamline your accounts process?

Tell us what the biggest financial issue in your business is right now. Your business is worth that time.

How precious is your time?

Contact Notch Above Bookkeeping today to get Xero, the world’s easiest accounting system setup and working for your business and saving you time so you can concentrate on making the most of work and personal life.

SG amnesty

Proposed SG amnesty legislation not enacted

If you've missed…

Small Business Superannuation Clearing House errors

3 tips to avoid common Small Business Superannuation Clearing…

Brisbane Xero Platinum Partners

Brisbane goes platinum with new Xero Platinum Partner, Notch…

https://notchabove.com.au/wp-content/uploads/2018/03/Brisbane-Bookkeeping-Notch-Above-Bookkeeping.jpg

667

1024

Notch Above

https://notchabove.com.au/wp-content/uploads/2017/09/Notch-Above-Bookkeeping-Service-Brisbane-Logo-300x136.jpg

Notch Above2019-07-22 13:56:542020-07-02 22:08:35Lost tax file numbers

https://notchabove.com.au/wp-content/uploads/2018/03/Brisbane-Bookkeeping-Notch-Above-Bookkeeping.jpg

667

1024

Notch Above

https://notchabove.com.au/wp-content/uploads/2017/09/Notch-Above-Bookkeeping-Service-Brisbane-Logo-300x136.jpg

Notch Above2019-07-22 13:56:542020-07-02 22:08:35Lost tax file numbers

STP reporting for small employers started 1 July

Small business clients need to be ready for STP by 30 September

Reporting…

The human cost of late payments

Late payments affect business from financial and operational…

Got cash for Christmas?

It would be nice if you could send an invoice, then sit back and watch the money roll in. But half of all invoices are paid late. And some aren’t paid at all. So how do you handle outstanding invoices so you can be sure to have cash for Christmas?

Speed up payroll processing for small business

Is it time to switch to cloud based-online timesheets?

Cloud-technology is rapidly changing the way small business owners do business. Your business, no matter what size, can have a state-of-the-art, easy-to-use staff scheduling and time-recording system. Read how.

What makes a good cloud accounting provider?

Making the move to the cloud makes sense for your business, but it’s important to understand that not all cloud organisations have the same standards. Consider the ten factors in this guide to ensure you pick the best cloud accounting provider.

Demystifying The End of Financial Year

Financial year-end can be a stressful time for small businesses, but it doesn’t have to be. Here’s what you need to get through it, and some tips on how to minimise the drama. What is the Australian financial year? The Australian financial year (also the Australian tax year) runs from 1 July to 30 June.

Effortless Submissions with Receipt Bank for Xero

If you still have receipts stuffed in your wallet, jacket pocket,…

Help! I can’t get my Xero accounts to balance out.

Xero is a powerful cloud accounting tool that has empowered many small business owners to take charge of their own finances. It’s a blessing for both business owners starting out and established businesses who rely on drawers of files and reams of paper.

Why it’s time for small business to fall in love with remote bookkeeping

Big companies have long adopted remote working as an acceptable or even equal way of doing business. And it can work for you too. Read how.

7 Budgeting Tips to TAKE CONTROL and Regain Financial Power

Have you ever felt like you’re just not getting ahead financially, and that even when your income increases you seem to be on a treadmill of spending every cent you earn and sometimes even more? Follow these 7 Budgeting Tips to TAKE CONTROL and Regain Financial Power.

Personal Budgeting & Avoiding Future Tax Troubles

After a good long break, I’d like to start 2018 by talking about personal budgeting. Although I deal with business finances, I can tell you that your personal budget is inextricably linked to your company’s success.

How Small Business Owners Strike A Work-Life Balance In Business

I always like to reflect on my business, especially around this time of the year as Christmas approaches. As a small business owner it's a perfect time to take a breather and ask the most important question...

How to Give More This Christmas By Spending Less

As a business owner, Christmas is the perfect time to give back to your clients, customers and employees. However, sometimes I have to play devil’s advocate with my clients when it comes to their Christmas shopping sprees.

3 Things You Need To Be Aware Of With Simpler BAS

As a business owner, I hope you’ve paid attention to a new…

5 Reasons Good Bookkeepers Are Worth Their Weight In Gold

Running a small business is a big juggling act, especially when…

Are you on track with your business goals?

As we come to the tail end of winter – hurrah! – some of…

Christmas in July? It’s possible with Xero.

It’s now a freezing cold July in Brisbane, marking the start…

What Are Your Super Obligations As A Business Owner?

Superannuation obligation is a tricky subject you need to tackle…

Take The Stress Out Of Your Day With These 6 Productivity Tips

After ten years of running my own business, I have learnt the…

Plan To Make Money In The New Financial Year

If there’s one thing you should start doing for this new financial…

How a Bookkeeper Counteracts the 3 Common Stresses of Small Business Owners

Being a small business owner is stressful. Reports, surveys and…

Xero For Small Business

If you missed it live here is a recording to the webinar Jac…

5 Silly Excuses We Give For Not Going Paperless

After years of handling clients’ data, I’ve found that a…

Is your Bookkeeper Up To Industry Best Practice?

With Valentine’s Day around the corner, I’ve thought about…

Numbers Ready for your Exit Strategy

Exit Strategy 101: Do you know how valuable your business is?

When…

5 Awesome Ways a Dashboard Helps Kick Your Financial Goals

Studying financial reports or an excel spreadsheet can be a chore.…

The top 5 Benefits of Cloud Accounting with Xero

Have you heard the hype about cloud accounting and wondered “how…

5 Quick Tips for Faster Customer Payments

Agree amounts upfront

Invoice immediately

Multiple…

3 Easy Steps To Identify Work Time Thieves

On average, Australian small business owners work considerably…

https://notchabove.com.au/wp-content/uploads/2014/05/eBook-transparent.png

855

571

Notch Above

https://notchabove.com.au/wp-content/uploads/2017/09/Notch-Above-Bookkeeping-Service-Brisbane-Logo-300x136.jpg

Notch Above2016-08-29 09:59:182017-11-14 10:40:474 TIME SAVING TIPS FOR SAVVY BUSINESS OWNERS

https://notchabove.com.au/wp-content/uploads/2014/05/eBook-transparent.png

855

571

Notch Above

https://notchabove.com.au/wp-content/uploads/2017/09/Notch-Above-Bookkeeping-Service-Brisbane-Logo-300x136.jpg

Notch Above2016-08-29 09:59:182017-11-14 10:40:474 TIME SAVING TIPS FOR SAVVY BUSINESS OWNERS

Demystifying the BAS Myths

I get a 2-week extension to lodge my BAS return through my business…

3 Easy steps To The First Holiday Dad Has Had In Years.

Does the prospect of going away on holiday away from your business…

The Xero Dashboard

The Xero Dashboard displays all of your most important financial…

Small Business Marketing Pt2

The top 10 must-have tips for email marketing

Part I of this…

How to nail invoice management

Build invoicing into the heart of your workflow

Some businesses…

Invoice Reminders in Xero

Instead of you spending hours chasing overdue payments, Xero…

Get Your Head Ready for the 2015/2016 Financial Year…

PLANNING FOR BUSINESS SUCCESS

~ Mark Creedon, Red Monkey Coaching.

The…

3 Must Have Tax Tips – Open Before 30 June

The end of the financial year is rapidly approaching. It is time…

Bank Reconciliation in Xero

Xero is designed to automatically import your bank, credit…

Statement of cashflow

For small businesses a healthy cashflow is crucial. That’s…

Does your business need a mobile site

First impressions are important

Your customers and prospects…

Security Advice from Xero

If you ever receive an unsolicited email that looks like…

Split Screen on your iPad

Save time and do more with Xero on your iPad!

Split-screen…

Small Business Marketing Pt1

Marketing on a budget

Large businesses often have dedicated…

Bank Rules in Xero

Bank rules in Xero will help you automate reconciling your…

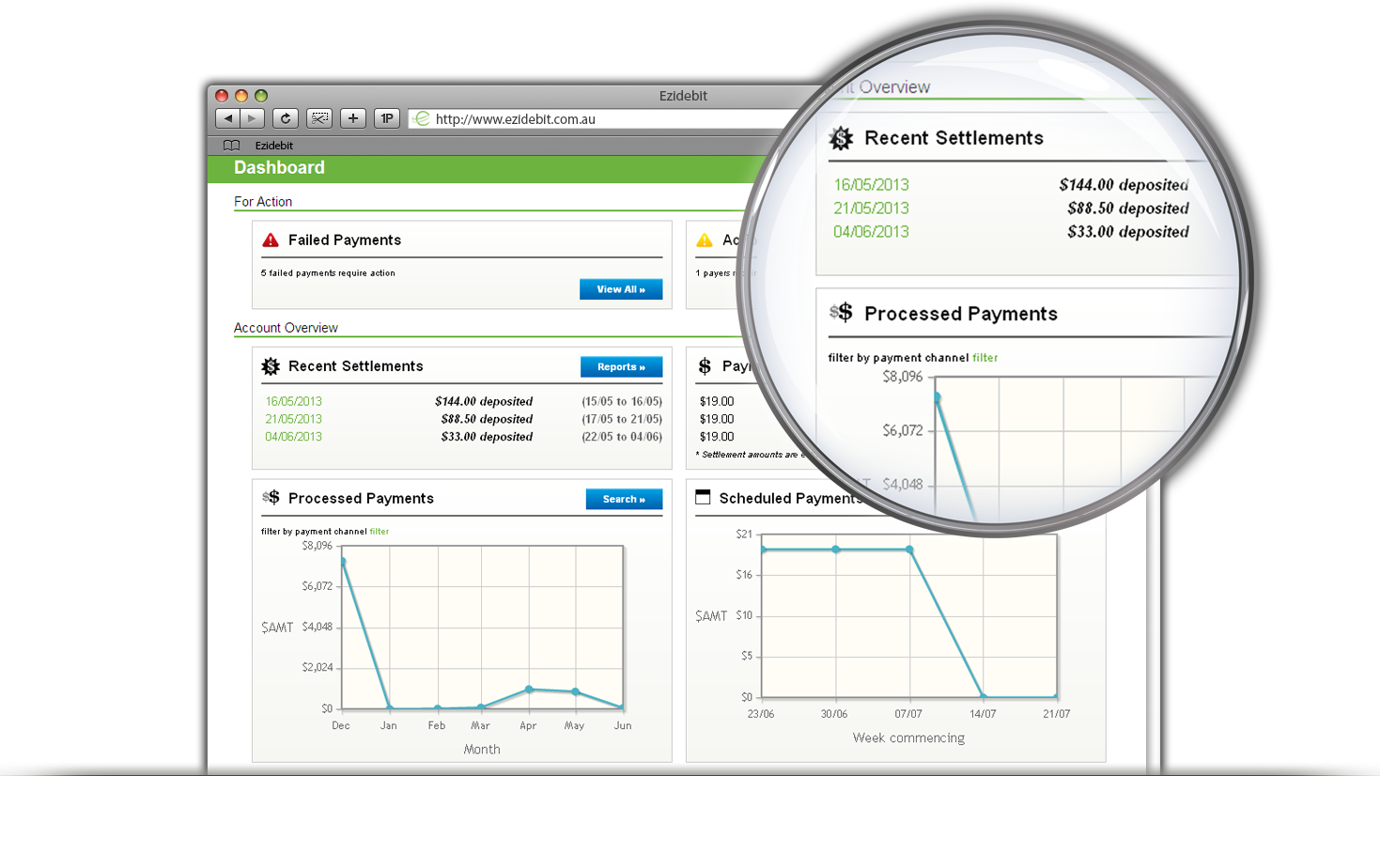

How automated payments can improve your competitive advantage

If you’ve been following our blog for a while, you will be…

Grow your business : 10-step checklist

10 steps for business growth

Seeing an opportunity for…

Sales & Online Invoicing in Xero

Xero accounting software helps make your sales and invoicing…

Manage bills and purchases in Xero

Managing your bills and purchases in Xero accounting software…

Billable expenses in Xero

Sometimes to get the job done you’ll incur expenses you…

How to apply for an ABN

An unique number for every business

An Australian Business Number…

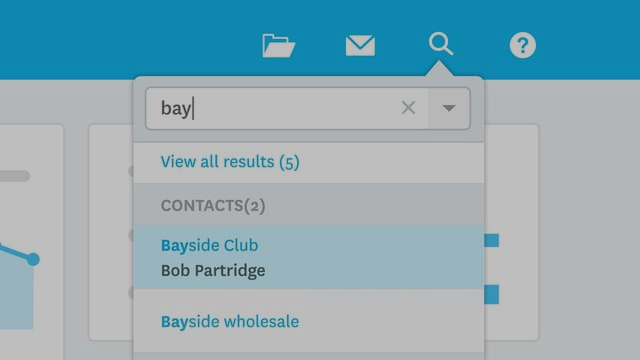

How to connect Xero to Gmail

Bring all your customer activity, transactions and emails…

Back to Basics

Sometimes we forget the basics of software programs we may have…

Two Step Authentication

Keeping your financial data safe from malware and hackers is…

4 Ways to Improve Small-Business Cash Flow

A lot of small-businesses focus on profit, but cash flow is just…

3 Tips to work smarter, not harder

The more efficient you can be in running your business, the more…

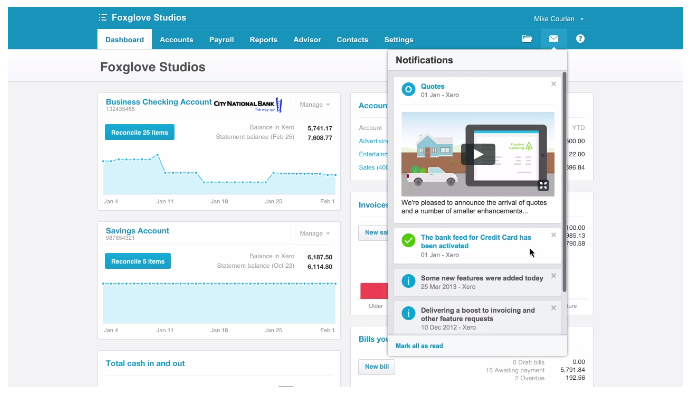

Notifications in Xero

Notifications in Xero makes it easy to stay on top of what's…

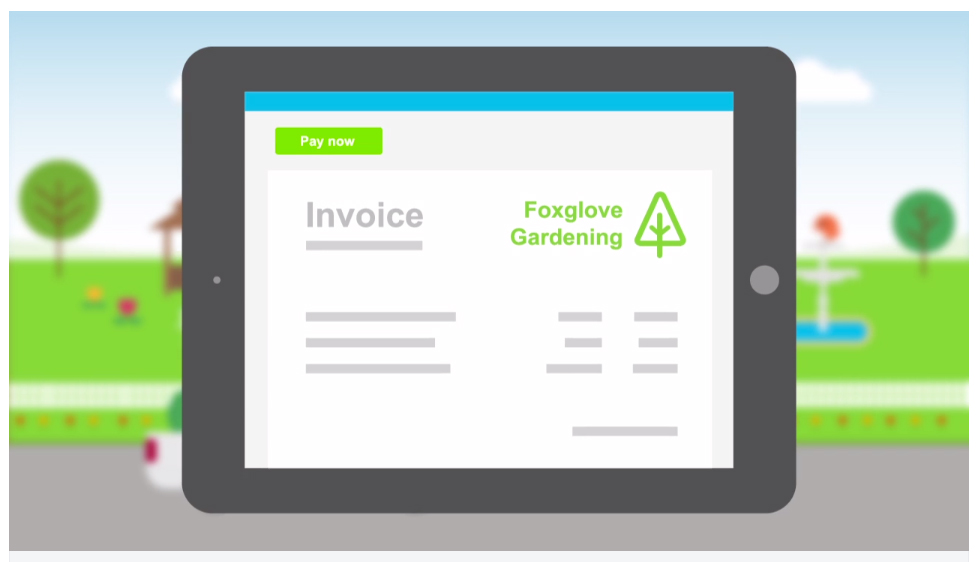

Sales quotes in Xero Released

On Wednesday Xero released the ability to issue quotes from the…

Collect your cash faster – Streamline your Invoice Process

Invoicing is an important part of small business accounting.…

The changing face of business software

If you started a new business a few years ago you would probably…

5 Secrets of Goal Setting for Successful Business Owners

For most businesses – especially those just starting out –…

Xero Quick Tip – Multiple Emails, One Invoice.

Here is a quick Xero tip for today. How to add multiple invoices to a contact to enable the invoice to be sent to all email addresses. Take two minutes to learn this time saving tip.

Lost in Venice: How Software Support Helps You Navigate a New Application

Have you visited Venice? Rising out of the Venetian Lagoon like…

Travel and Tax Deductions

Claiming a tax deduction for travel-related accommodation and…

Receipt Rage? Keep Calm and Follow These Tips

Along with flying cars and holidays on the moon, the 21st century…

We Vote for OneNote

If you’re anything like me, you’ll get your finest inspiration…

Is My Data Really Secure with Xero?

Given recent global events in which sensitive financial data…